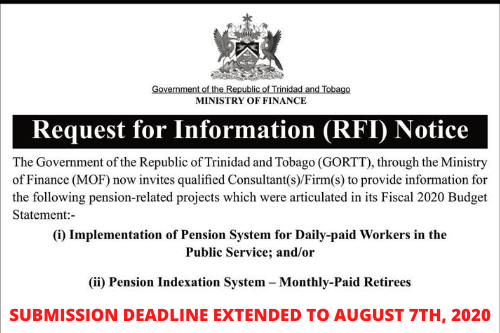

Request for Information (RFI) Notice

The Government of the Republic of Trinidad and Tobago (GORTT), through the Ministry

of Finance (MOF) now invites qualified Consultant(s)/Firm(s) to provide information for

the following pension-related projects which were articulated in its Fiscal 2020 Budget

Statement.

ENTREPRENEURIAL RELIEF GRANT

Micro and Small Enterprises that have been negatively impacted by the COVID-19 pandemic are invited to apply for the Entrepreneurial Relief Grant from the Ministry of Finance in collaboration with NEDCO.

Media Release – APPLICATION FOR VAT BONDS

VAT Registrants are reminded that the Board of Inland Revenue (BIR) continues to accept applications for VAT Bonds. Application forms can be accessed at the Inland Revenue Division’s (IRD) website at www.ird.gov.tt. These forms must be completed online, printed, signed and e-mailed to VATBonds@ird.gov.tt.